How I Spent 2011 – Literally.

This is a little sad, but as 2011 came to a close I started to get an inkling of excitement … not about 2012 and new beginnings … no, no. I was excited about completing a whole year’s worth of tracking every fils that came in or out of my proverbial purse.

Perhaps what I am most happy about is the fact that I actually stayed committed. Having said that, I must say that there is no sensation quite similar to feeling like you are Scrooge McDuck – counting your cash everyday …

You’ll find two posts about my spending patterns in 2011:

Enjoy those and I’ll try not to repeat any of the details in there here. Also, I decided to take out one of the biggest spends I had in 2011: paying off my car. The rationale is that you do not buy a car every year (… take a moment to feel decadent if you do … done? Ok, lets continue …) making that expense a negligible outlier.

Before we get going, here’s what we’ll be talking about:

- How did this all start … No really, how?

- A Year in Brief: A quick summary of spending

- Category Emmy Awards: and the biggest spending award goes to …

- Food: Who made me fat and happy this year

- Telecommunication: Alo? Kthxbai.

- Budget: Set it and don’t budge.

- Finances with Benefits: was it worth all the effort?

- Counting for Noobs: How you can start your own personal savings effort.

Let’s go …

How did this all start … No really, how?

At the end of 2010, the little elves working in my savings account started getting fat and lazy from the lack of work they had to do. Whilst not exactly on the breadline, working for the 2nd oldest industry meant that I could probably see the people standing at it …

There are two sure ways to bulk the bulge in your pockets: make money and/or save it. The latter was the quicker option.

I stared to look online for models to help me save (not the Victoria’s Secret kind of model … but if you are reading this now and you’re a VS model, please feel free to save me) … There are plenty of brilliant solutions out there now, but none of them did what I needed to do at the time: categorical tracking of expenses across accounts over a period of time with the flexibility of generating custom reports. So I decided to make my own model using MS Excel …

So I fired up the application and got on with it … except, I didn’t know where to start.

Most online websites talking about personal savings recommend that you “create your categories” … rubbish! I had no clue what categories I was going to use and the ones online were so generic and presumed I had a family of 3 with another on the way …

Instead of starting with categories, I just started tracking my expenses and categories emerged over a 1 month period. This kept going for 365 days … and here we are today! Hello.

A Year in Brief: A quick summary of spending

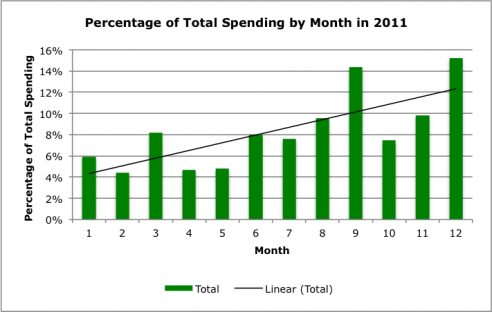

The graph above shows how my spending was distributed during the year. I travelled both in September and in December (oddly enough to the same place) which shows how predictable my spending is … I also had to dash out some cash for insurance in September … so you can deduce that I had a little bit more fun travelling in December XD #happyNewYear

Jokes aside, this graph should really show a relatively flat trend line – because if I was sticking to my budget, I would not have had an odd increase in June, July, August, October, and November compared to the first half of the year. We’ll get to budgeting later.

So lets see how this fizzles out …

Category Emmy Awards: and the biggest spending award goes to …

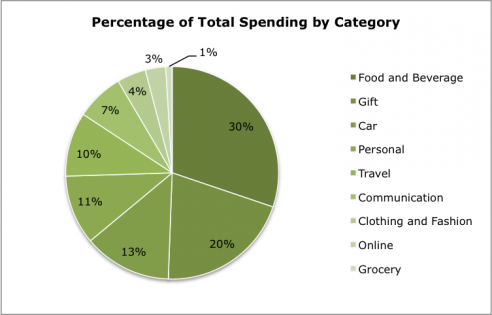

Mah belleh!! The round rascal is filled with happiness that keeps me warm in the winter … We’ll dig deeper into the food category later and see exactly who has been making me fat … and it’s not because my belly’s high maintenance …

Of course this has a lot of behavioural implications: for example, I nearly never go grocery shopping (probably because I’m always full!). If you are very clever you can make a lot of accurate assumptions about my personality and what makes me tick from this … but I’ll leave that for you to figure out :]~

Runner ups for this award were Gifts! 12 months, 52 weeks, 365 days – can you calculate the probability of finding an opportunity to make someone smile on an occasion? There were 5 types of gifts this year. In order they were Birthdays (58%), Gratuity – it’s nice to say “thanks” (29%), Congratulatory (6%), Donations (4%) and Babies (2%). The only concern I have here is that the ratio spent on Gifts was so far away from Food! I’ll have to have a chat with my appetite – it’s being greedy.

This also tells me I need to do more of something I thoroughly enjoy ~ travel. It’s good for the soul.

Food: Who made me fat and happy this year

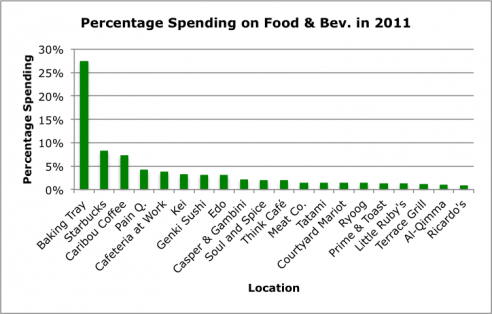

Before we get into the specifics: Food and Beverage in 2011 was consumed at Café’s (52%), Restaurants (39%), Delivery (8.8%), and only 0.2% was spent at Fast Food joints #epicWin.

The graph below will only show the top 20 locations (of a total of 98 places) which make up for 78.5% of all my spending on food.

Hey! look at that, it’s the 80, 20 rule – 80% of all my spending is at 20% of all the locations I’ve visited.

The gist of it is, I spend a lot of time at Baking Tray – those of you who know me are now thinking “because of Qooqies” … yes damn it! yes. Also because the people that work there are brilliant, the food is healthy, the people that work there are brilliant, it’s conveniently located next to my workplace, the people that work there are brilliant, the people that go there are awesome, the people that work there are brilliant, and QOOQIES!

So for 2012, if I wanted to be smarter about spending, I would look for a cheaper alternative. I could also change my diet and eat less qooqies, but that only happens in the movies. Another good option is to stop eating at restaurants that account for much of the one time spends that take up a large share of my wallet (39%).

The trouble with cutting down on Food is that it hacks away at my principles … I like to eat good food and I exercise to eat a lot of it >.<' it's a terrible vicious and delicious cycle that I'm stuck in ... we'll see how I manage in 2012!

Telecommunication: Alo? Kthxbai.

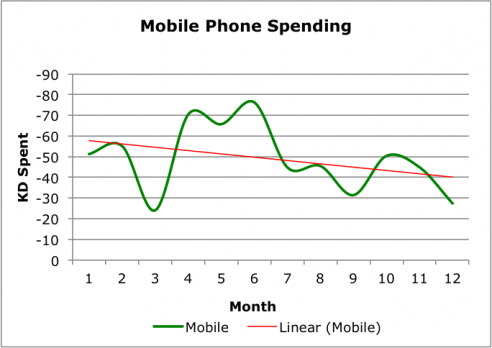

One of my goals in 2010 was to reduce spending on telecommunications. This might not sound like a lot to some people out there but my phone bill used to hit three digit figures – I was at a loss for words every time the bill came …

Thanks to iEverything, talking on the phone just makes little sense anymore. I can get more done in a Tweet, Mail, or iMessage than I could with a phone call. I managed to make International Calling walk the plank too – not with technology, I just stopped calling >.<' In 2010, 30% of my spending went towards phone bills. In 2011, that number was a lot less. If I find a cheaper alternative to access the web through my phone anywhere, I can probably reduce this even further - but the amount would be minute compared to improvements I could make elsewhere. Budget: Set it and don’t budge.

The whole concept of budgeting is to discipline yourself to commit to a number as a ceiling. I’m very bad at commitment, so instead I set unrealistic goals and try to stay as close as possible to those … having said that, on average in 2011, I spent 127% of what I budgeted for and stayed within budget only 2 months of the 12 in the year (1/6th). Poor performance, but … the caveat is in the next section!

Finances with Benefits: was it worth all the effort?

Despite having been over budget almost every month of the year, I have made a significant savings by tracking and managing my spending … every day.

If we don’t consider paying off my car, I would have potentially saved 47% of my total income by doing this (money to invest elsewhere perhaps).

Is it a hassle? Yes. There is no doubt about that. Don’t be fooled by Scrooge McDuck, counting cash is not fun – but the benefits are apparent. The best part is, I can’t remember the last time I looked at my accounts and thought to myself “o.o fffuuuuuu!… where’d I spend my money?!”.

I now know!

Counting for Noobs: How you can start your own personal savings effort.

Right, so you want to know how to do this yourself? In 2011, I gave my excel sheet to 2 people, and quickly realised it was way too complicated (because I tend to over complicate things). If you really want the excel model I use, just contact me, I’ll give it to you and I’ll even offer to walk you through it (by phone or over coffee). You can find my contact information on my resume

There are other alternatives that do the same thing. One of the better options I’ve found is available on the iPhone: Money for iPhone by Jumsoft. My friend also suggested a website the other day, I can’t remember what the address was for the life of me, but I’ll update as soon as I’m done.

Closing Comments

It’s fun. It helps you improve. It’s a way to remember the things you did. It’s a lot of commitment.

Saving wont make you a millionaire. Tracking your expenses will just tell you how fast you’re not becoming a millionaire.

Finally, if you are my boss and you’re reading this post … this information is not to be used to justify a stingy bonus recommendation next year #sarcasm #myBossRocks

I love your work and well done!! I always wanted to do something like this but it was always a failure for some reason. Wish u a good 2012 full of wise spending and increased saving 🙂

Thanks Aziz ;]~

Where do the gym & football expenses go?

MBH football I put under Personal – Entertainment – Football.

The gym expenses I put under Personal – Health and Beauty – Gym. :P~

Qooqies might go into health and beauty soon too XD

When it comes to phone bills, you’re better off budgeting minutes rather than cost. For example, I expect to spend 30 minutes making calls per day, therefore 930 minutes per month. Zain has a voice plan that costs 20 KD and gives you 1000 minutes, so with that, I’ve secured my ceiling and my bills are stable.